In short

The challenge

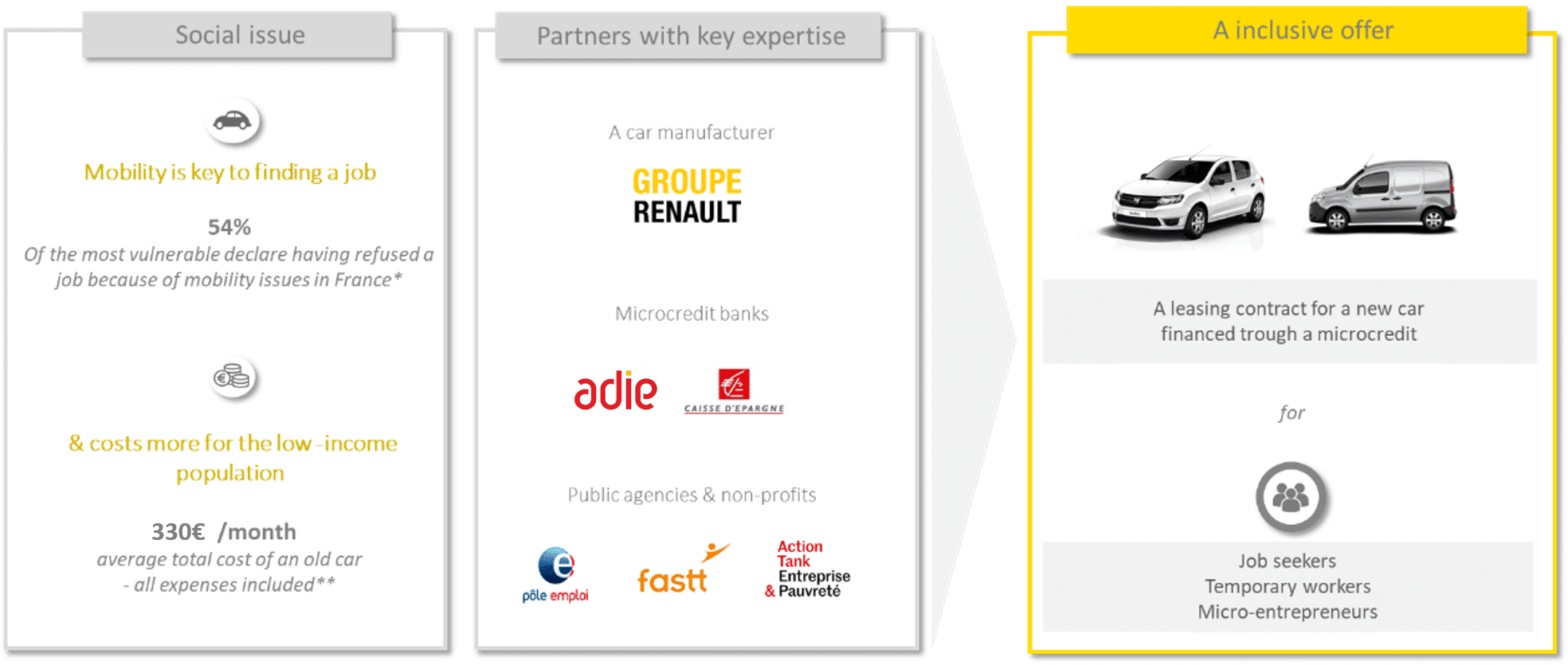

For many, having a car is key to finding or keeping a job. But people who are unemployed, in precarious job situations, or that have bad bank records do not have access to traditional credit. These people are left with very few options when they want to buy a car: they either pay cash or resort to peer-to-peer micro-lending. The cars they buy are usually old second-hand high-mileage cars, which means their acquisition is on the whole more costly (if not more risky) – what we refer to as the “poverty penalty”. The “Club Mobilité” project aims at easing access to brand new cars enabling beneficiaries to reduce and better manage their mobility budget.

What we offer

The car we offer is a brand-new Dacia Sandero (urban vehicule) or a Renault Kangoo (commercial vehicule) through a lease-purchase contract. The prices start at 80 €/month without any initial contribution. The monthly payments depend on the length of the contract, the mileage and level of equipment chosen by the beneficiary. Club Mobilité clients also have access to reduced prices for repair and maintenance (using Renault Mobiliz’s preferential rates). The loan is financed through a microcredit, ensure the offer is accessible to all.

Our partners

Read more

For many, having a vehicle is key to social and professional integration. Struggling to buy a car or to get a driving license has been identified as one of the main barriers to finding or keeping a job. Many low qualified jobs have high mobility constraints (underserved by public transportation, staggered hours, frequent location changes…)

But people who are unemployed, in precarious job situations, or undergoing banking difficulties do not have access to traditional credit to buy or rent cars on the long run. Cash purchase or peer-to-peer micro-lending are the only options they have to buy the car they need. Usually, the vehicle they end up buying is second-hand, old and with high-mileage, which clearly constitutes a poverty penalty. Statistics show that through a microcredit, they generally have access to an average budget of 3200€[1] . They then buy what is available on the market for that range of price: 10-year-old vehicles with mileage over 150,000 km, and most of the time without any warranty. The annual user cost is 900€ higher than the cost of owning a new or recent car[2]. Besides, using an old and high-mileage car that can break down at any moment causes additional stress.

Furthermore, the global user cost of having a car is a significant budget that can be difficult to handle. The average total cost of an old car (all expenses included: car, repair-maintenance, gas, insurance…) is around 310€/month, which represents 30% of the French minimum wage[2] …

Renault and la Fédération Nationale des Caisses d’Epargne decided to gather around the Action Tank to address these constraints and find an adequate offer. These stakeholders were supported in their research by community and public organizations such as the “Fonds d’Action Sociale du Travail Temporaire” (FASTT), an organization providing support to temporary employees; “Pôle Emploi”, the employment agency; and two microcredit organizations, “ADIE” and “Parcours Confiance” (founded and financed by la Caisse d’Epargne).

[1] Parcours Confiance, Caisse d’Epargne, 2015. [2] Study on total cost of automobility done by the Boston Consulting Group (2015)

Identified actions of improvement

Bringing these partners together enabled us to have an impact on the global car budget. The offer that was designed takes into accounts the needs and capabilities of the targeted audience. These needs are well known by the social organizations with whom they have regular contact.

Thanks to a 2015 analysis of the global cost of car mobility conducted by the Boston Consulting Group, we identified the lease-purchase contract as the best solution for our target. The study showed that the savings that could be made on gas and maintenance would compensate the extra cost of owning a new vehicle. Besides, it is easier to manage and foresee car-related expenses with a new vehicle than with a second-hand one. Indeed, second-hand cars come with a whole lot of bad surprises, including unanticipated repairs..

The mechanism we use is a purchase-lease contract funded through microcredit, which enables us to ease access to a new car without exceeding the microcredit cap – which is 5000 € for individuals and 10 000 € for professionals. The client repays his loan on a monthly basis, during a chosen time period. The purchase-lease contract enables the customer to commit to a lower credit amount and on a shorter time -period. It is a key element of our offer because modest incomes are often reluctant to engage in long-term contracts.

At the end of the lease contract, the customer can either return or buy the car.. If needed, a second microcredit and new monthly payments can be settled.

Our offer in details

The experiment started in October 2015 in the Greater Paris region. The first initial prescriber which redirected the targeted audience towards our offer was the FASTT, an organization working with temporary workers. In February 2016, a second version of the pilot-project was launched so that the results and initial drawbacks revealed by the full-scale experiment could be taken into account. The testing ground was extended to the region of Grand Est and Bretange. Pôle Emploi, the national employment agency, started prescribing our offer to the targeted jobseekers.

Given the number of actors involved, the Action Tank coordinated the project and provided phone support and advice to potential clients. That enabled us to understand closely the need of our targeted population.

In 2018, we are scaling-up to nationwide coverage and institutionalizing the program by creating a social-venture “Club Mobilite” co-owned by l’ADIE, la Fédération Nationale des Caisses d’Epargne, Renault and the Action Tank. We are now working on consolidating our project to ambitiously grow our impact (digital tools, economic model…).