In short

The challenge

Comprehensive home insurance products are complex. Insurers have very different ways of covering risks. The products they offer are either standardized (one housing typology = one standard price), either very specific (using actuarial methods[1] ). Each insurer has his own general terms and conditions, and his own capital guarantees, which vary according to the severity of the incured loss.

Plaine Commune Habitat (PCH), a social landlord in the North of Paris, made contact with the Action Tank to discuss two different matters :

- Tenants in social housing often face two situations : they are either uninsured because they cannot afford an insurance, which can put them at risk ; or they are over-insured because of flawed information, which compromises the disposable income they are left to live with every month

- Up to now, very few solutions have been implemented to improve the level disposable income they are left to live with every month

PCH contributed to the launch of tenants’ club called « Club des locataires » (CDL) in September 2016. The Club offers access to quality goods and services for all the tenants, through mutualization.

The question of access to an insurance that would match the needs of social housing tenants has not been fully addressed yet. The experiments until today have been small scale and not yet conclusive.

[1] Actuarial methods rely on an estimation of the financial impact of a risk and the associated cashflows.

What we offer

The comprehensive home insurance we offer is provided through Rodassur, a local insurance broker, in partnership with the Club des Locataires. The price was negotiated without impairing the guarantees. Capital guarantees are also adapted to the tenants’ profile. The offer is simple with a single price depending on the housing typology, and a unified claims ratio.

The prescription of the insurance relies on the involvement of tenants through the Club des Locataires. The broker’s permanence within the Club’s premises guarantees a good transformation rate.

Our partners

Read more

Comprehensive home insurance products are complex. Insurers have very different ways of covering risks. The products they offer are either standardized (one housing typology = one standard price), either very specific (using actuarial methods[1]). Each insurer has his own general terms and conditions, and capital guarantees vary according to the severity of the incured losses.

Plaine Commune Habitat (PCH), a social landlord operating in the North of Paris, manages 17,500 housing units across the agglomeration of Plaine Commune. The landlord made contact with us after having read the report on the « double penalty » of poverty, being aware that its tenants were undergoing difficulties. Plaine Commune partnered with the Action Tank to create the « Club des Locataires ». This tenants’ club aims at facilitating access to quality goods and services by relying on mutualization mechanisms.

A preliminary study was conducted to learn more about the needs and expectatioons of tenants. The results showed a pressing request for home insurance products. Some tenants expressed difficulties in paying for an insurance premium, leading them to give up on insurance. Other tenants said they were insured several times for the same object. In both cases, they were seeking alternatives.

PCH contributed to the formulation of its tenants’ expectations and was committed to find viable solutions for its tenants.

This is why PCH partnered with the Action Tank in 2014 to launch a programme enabling access to a comprehensive home insurance plan called « Eco-insurance ». The same year, a feasibility study by the Boston Consulting Group was conducted.

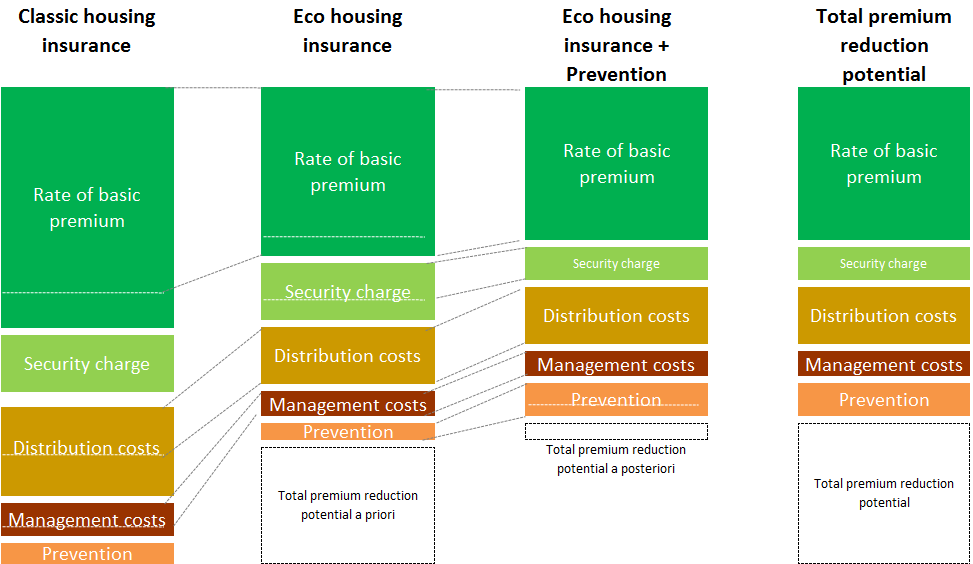

Adaptation of the product

-

Adjustment of the amount of capital insured

-

Adaptation of the loading for contingencies

-

Reduction in commercial loading

-

Optimization and adjustment of deductible

Improvements in the process

-

Optimization of the distribution network

-

Optimization of the claims management

Awareness campaigns and prevention

-

Encourage prevention and awareness campaigns, with the support of the landlord and the « Club des Locataires ».

Value redistribution

-

On the long run, evaluation of the programme’s impact and readjustment of the product

-

Downward revaluation of the premium if the claims ratio improves.

The housing insurance programme relies on an ecosystem of partners (NGOs, insurance bodies, PCH landlord) who wish to implement innovative solutions to cover risks and reduce vulnerability. The different steps of our approach were (1) the understanding and definition of insurance needs, (2) the identification of the level of coverage that was going to be useful for the beneficiairies (while maintaining its quality), (3) the orientation of potential customers towards local partners.

[1] Actuarial methods rely on an estimation of the financial impact of a risk and the associated cashflows

The comprehensive home insurance we offer is provided through Rodassur, a local insurance broker, in partnership with the Club des Locataires. The price was negotiated without impairing the guarantees. Capital guarantees are also adapted to the tenants’ profile. The offer is simple with a single price depending on the housing typpology, and a unified claims ratio.

The prescription of the insurance relies on the involvement of tenants through the Club des Locataires. The broker’s permanence within the Club’s premises guarantees a good transformation rate.

Study of Levers

Two working groups were set up by the Action Tank. They involved Plaine Commune Habitat, an NGO with international expertise in insurance called « MIIIR », a focus group of tenants, and an insurer. Both groups helped elaborate specifications on loss management, prevention, characteristics of the product, distribution…

Brokerage appeared to be the most appropriate solution because it introduced a lot of flexibility in the articulation of processes, allowing for portfolio diversification and a better sharing of risk. Rodassur, a local broker who has been operating in Saint Denis for more than 35 years, signed a partnership agreement with the Club des Locataires and the Action Tank. Rodassur agreed to pilot the project, with support from the Action Tank and the Club, and regular follow-ups.

The next steps of the project :

Launch of the product (September 2016):

- Launch of the insurance product in September 2016

- Close follow-up of suscriptions through a dashboard. In September 2017, 230 contracts had been signed up

Study of the process (September 2017 – June 2018):

- Creation of a working group with La Banque Postale to reflect on :

- the distribution channel of the product

- the improvements that can be achieved regarding loss management

- intensification of prevention